Somerville Real Estate Market Review: 2024

Introduction

As we look back on 2024, I am excited to share with you a complete breakdown of Somerville neighborhood data for:

Average rental prices for 1, 2, 3, and 4-bedroom units

Average sold prices for 2 and 3-family properties

Average sold prices for 1, 2, 3, and 4-bedroom condo

If you want to skip the high-level data summary and jump RIGHT to details on your neighborhood only, click on one of the links below:

Gilman Square ✦ Magoun Square ✦ East Somerville ✦ Sullivan Square ✦ Davis Square

Porter Square ✦ Ten Hills / Assembly Row ✦ Ball Square ✦ Union Square

Data Summary

This data could be valuable to you in several cases:

If you’re an investor or thinking about becoming an investor, these data points will help you figure out on a high-level what you can roughly expect for rental rates in various neighborhoods based on bedroom count for rentals as well as condos. You’ll also have a better understanding of what you’ll need to pay to purchase multi-family properties.

If you are a primary buyer looking for a condo, you should have a pretty good idea of what neighborhoods are likely to be affordable for you and which ones are likely out of budget or pushing it.

When you see fields that are marked “N/A” there were not enough data points for that specific category. Generally this means there are not a lot of sales or rented units for that specific property type. This is actually valuable information, because if you are looking in a category that is marked N/A as a primary buyer, it signals it may not be easy to find or what you’re looking for may not exist at all - in other words, there’s a good chance you’ll need to adjust your search.

A few quick caveats on the data:

The data is from MLSpin. Understand that there are many rentals that happen off MLS and are not covered in this data set.

No off-market data is included.

Some fields have N/A. We require a minimum 10 rental data points or 3 buy/sell data points to populate data.

All neighborhood locations are a 0.5 mile radius from their T or commuter rail stop.

There was insufficient data to include studios this year.

After looking at this data, are you concerned your rental is underpriced or overpriced? Are you curious about selling or investing in multi-families? Are you thinking of buying a condo and feel overwhelmed? Please give me a ring to discuss anytime at 617-833-7457. Read on for my thoughts and analysis.

Neighborhood Deep Dive

Continue reading for my thoughts on each neighborhood. If you don’t want to scroll to find the neighborhood you’re interested in, just click on one of the links below.

Gilman Square ✦ Magoun Square ✦ East Somerville ✦ Sullivan Square ✦ Davis Square

Porter Square ✦ Ten Hills / Assembly Row ✦ Ball Square ✦ Union Square

Gilman Square

This area of Somerville continues to grow and has a lot of potential in my mind. The first thing to note here is the rental prices compared to other parts of Somerville. For 1-beds Gilman lands at $2,304, which is in 8th place out of 9 neighborhoods in Somerville. On the surface this sounds not great, but the highest price for a 1-bed in all of Somerville was in Ball Square and is only about $450/month higher.

And this is where Gilman is really interesting - when you compare the multi-family market of Ball Square to Gilman, you see that a 2-family in Gilman sold on average for $1.22M compared to $1.66M for Ball Square. My question is, are you willing to spend an extra $440k for potentially an extra ~$5000/yr per unit? I don’t know if that makes sense for most investors I work with, although a case could be made in some scenarios.

Magoun Square

Magoun Square is similar to Gilman in many ways, with similar rental numbers across the board. Magoun Square is also an up and coming area that continues to change, now that the new green line T stop is in place.

Magoun Square 3-family sold prices are actually quite high for an up and coming area, with average prices at $1.625M. I expect those numbers to continue to grow over time. You will also notice that condo sold prices in Magoun Square are also quite high, particularly for 3-bed and 4-bed units.

This is an indication that Magoun Square could be a great area to buy in if you are a primary condo buyer (as I expect demand in this area to only increase with time) OR if you are a developer considering a flip.

East Somerville

East Somerville clocked in with very solid rental numbers this year. In past years, East Somerville has had among the lowest rental numbers in Somerville, but it seems to have caught up this year. It’s possible that part of this comes from the East Somerville green line T stop increasing demand in the area. On the ground it also feels like rental demand in some parts of Somerville has decreased, so perhaps renters who previously targeted more mature markets like Davis or Porter Square are shifting to more affordable areas like East Somerville.

East Somerville, similar to Gilman and Magoun Square, also has some of the lowest multi-family sales numbers. I expect this to remain unchanged for a while. Having said that, these numbers are still not bad and I know many landlords in this part of town who purchased years ago and have seen excellent returns over the long run.

The condo market in East Somerville was somewhat middle of the pack this year. When rates come up, neighborhoods that are lower priority for buyers tend to take the biggest hits and on the ground it feels like East Somerville condos have softened a bit. The flip side here is that if rates come down at some point in 2025, I would expect a boost in the number of transactions here and I would also expect prices to jump up a significant amount.

Sullivan Square

Generally Somerville rental units very close to Sullivan Square have the lowest rental numbers in town every year and the same was true for Sullivan Square this year virtually across the board. The reason is partly that Sullivan Square is on the orange line, which is generally considered less desirable than the red or green lines, so units close by tend to attract tenants on more of a budget. I don’t see this trend changing much for the next few years at least.

One thing that did surprise me this year, was that the average sold price for 2-families went up quite a bit. It’s hard to know where this is coming from, but if you have a multi-family close to Sullivan and you are mulling a sale, from my POV now could be a nice time to either cash out or 1031 into areas with more long-term upside.

Finally, the condo market in Sullivan Square had some of the lowest prices in all of Somerville. If you are dead set on owning a condo in Somerville and you are having trouble finding other affordable options in Somerville, Sullivan Square may be a good route to go and you are likely to get more bang for your buck when it comes to space and quality compared to virtually anywhere else Somerville.

Davis Square

Davis Square finished essentially 1st across the board when it comes to rentals, which is to be expected. Davis Square is a mature market and along with Porter Square, these two areas tend to attract extremely high quality tenants and the highest rents in all of Somerville.

You’ll notice that the multi-family sold prices are also among the highest for all of Somerville with an average 2-family sold price of $1.69M. If you are looking for a very safe real estate investment, it is hard to lose long-term with Davis Square.

I do feel like Davis Square has become slightly more sleepy since COVID hit and the recovery has taken longer than I expected. But with the new opening of H-Mart and my general observations of what I see on the ground, I see Davis Square recovering nicely and I expect really solid growth here long-term.

Finally, the Davis Square condo market remains extremely strong, particularly with larger units (3-beds coming in at $1.312M and 4-beds at $1.473M). If you are looking to be very close to Davis Square, expect to pay a serious premium to get into this part of Somerville but also expect nice annual returns on your property over the long haul.

Porter Square

I mentioned it in the Cambridge section of Porter/Davis and I’m mentioning it again here - I often group Porter and Davis Square together in my head because you find that the tenant pools, buyer pools and data points tend to be fairly similar. That is reflected in the 2024 data.

Just like Davis Square, we are dealing with a mature market which means really solid rental numbers/tenant pools and buyers who are typically offering over asking with little/no contingencies to get into this market.

If you are thinking of purchasing in this area, expect competition and if you are an investor, expect solid, long-term returns without a lot of the hassle that comes with some other parts of Somerville and other surrounding areas.

Ten Hills / Assembly Row

Ten Hills is a hidden gem of an area which is often overlooked by potential investors or home buyers. Why is it a hidden gem?

First, it’s right by Rt-93 which allows for easy commuting. Next, it’s right next to Assembly Row/Station Landing, which provides easy access to the orange line as well as grocery shopping, cafes, restaurants, and more. Finally, it’s right on the Mystic River, so it makes for some excellent walking/jogging paths in the warmer months. So it’s a very convenient place to live.

But the numbers also demonstrate why it’s such a great value. Ten Hills has very solid rental numbers, particularly for 1 and 2-bed units, compared to virtually anywhere in Somerville. And it has by far the lowest average sale price for a 2-family, coming in at “just” $1.06M. While that’s a ton of money, for Somerville standards that is cheap for a 2-family.

There is also lots of planned development around Assembly Row including lab space, so there is a lot of long-term upside here as well.

Finally, you’ll notice the condo prices are on the low end so this could be a great place to buy if you are looking to get into the Somerville market. The only downside is that this area is very small so inventory can be limited.

Ball Square

In perhaps one of the biggest surprises of the year in my mind, Ball Square came in first in both 1-bed and 2-bed rental prices for 2024. Ball Square also brought in very high average sale prices for both 2 and 3-family properties.

While I like Ball Square, I am not sure if the juice is necessarily worth the squeeze for some of the multi-family properties I have seen sold over the years. I am not saying I would not recommend buying in this part of Somerville, but I am saying you need to be really discerning with the particular property to make sure you aren’t overpaying for what kind of rental income could potentially come in.

I do believe Ball Square is a bit overhyped based on what I see on the ground and how a lot of transactions play out here, but I do think with patience great deals can be had in this part of Somerville.

Finally, you will notice some of the highest condo sold prices took place in Ball Square. Clearly this area is getting hot, but be careful not to get sucked into the excitement and soaring prices of Ball Square.

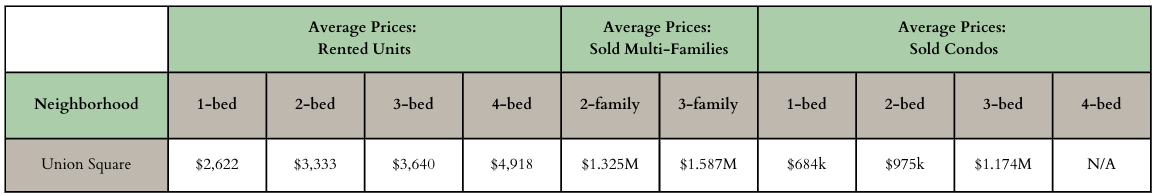

Union Square

Union Square rental numbers continue to rise. This year Union Square had the 3rd highest 1-bed numbers and 2nd highest 2-bed numbers. I expect this trend to continue as Union Square continues to become hotter and hotter.

I still think there are good opportunities to get into the Union Square market - multi-family prices have gone up but they haven’t skyrocketed yet. I also think purchasing a condo in Union Square is a great move - whether as a primary home or as an investment.

And that wraps up the latest data and my analysis on Somerville! If you want to discuss further, give me a ring/text at 617-833-7457 or shoot me an email at Sage@CambridgeSage.com